April 22, 202124, 2023

Dear Fellow Stockholders:

You are cordially invited to join our Board of Directors and senior management for the 2021 annual meeting2023 Annual Meeting of stockholdersStockholders (the “Meeting”) of Red Violet, Inc. to be held on Wednesday, May 26, 202131, 2023 at 11:00 a.m. Eastern Time. Due to the public health impact of the coronavirus pandemic and to ensure the health and well-being of our stockholders, employees and other parties, we have decided to forego the physical MeetingTime in favor of a virtual-only Meeting this year.format. To participate, vote or submit questions during the Meeting via live webcast, you must register in advance at www.proxydocs.com/RDVT prior to the deadline of Tuesday, May 25, 202130, 2023 at 11:59 p.m. Eastern Time and provide the control number as provided in the proxy card, or voting instruction form. Upon completing your registration, you will receive further instructions via email, including unique links to access the Meeting and to submit questions in advance of the Meeting. Information on how to participate in this year’s Meeting can be found on page 1 of the Proxy Statement.

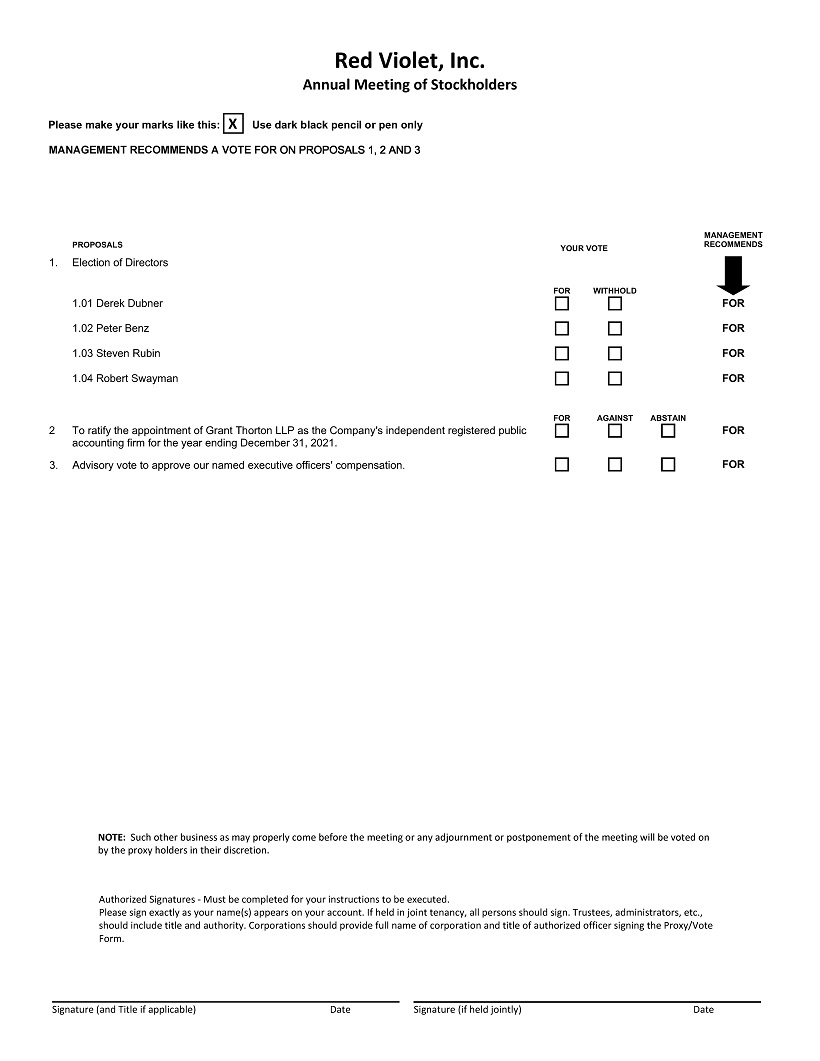

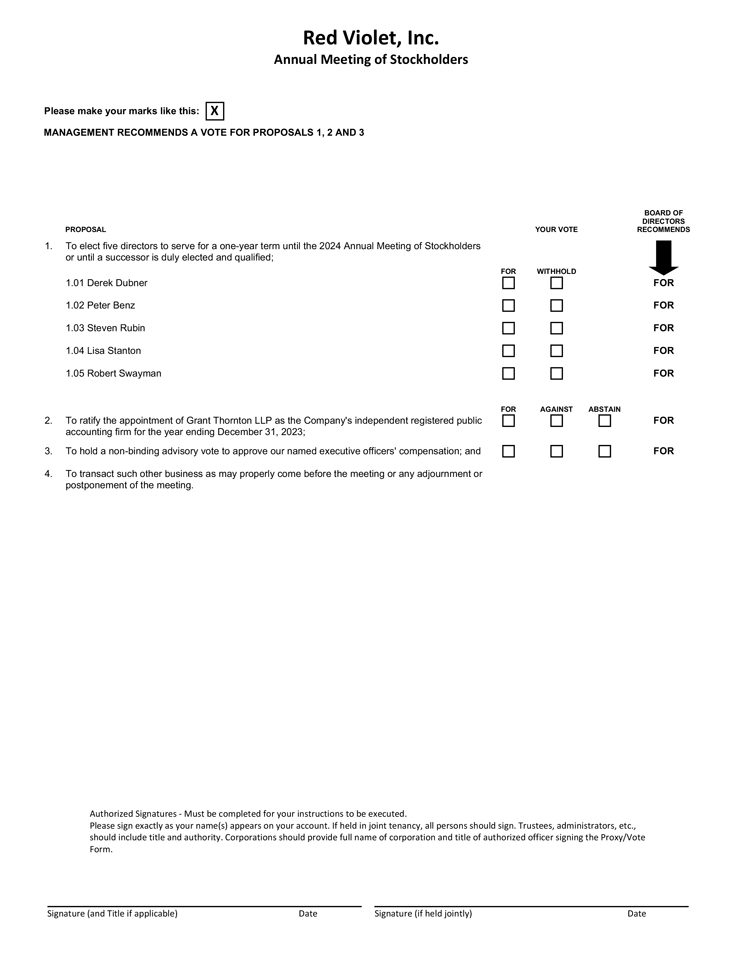

The formal Notice of Meeting of Stockholders and Proxy Statement describing the matters to be acted upon at the Meeting are contained in the following pages. Stockholders also are entitled to vote on any other matters which properly come before the Meeting.

Your vote is very important to us. Enclosed is a proxy which will enable you to vote your shares on the matters to be considered at the Meeting, even if you are unable to attend the Meeting. Please use the Internet voting system, telephone voting system or mark the proxy to indicate your vote, date and sign the proxy and return it in the enclosed envelope as soon as possible for receipt prior to the Meeting.

On behalf of your Board of Directors, thank you for your confidence in red violet. We look forward to your continued support.

Sincerely,

Derek Dubner

Chief Executive Officer